Our Services

Life Insurance

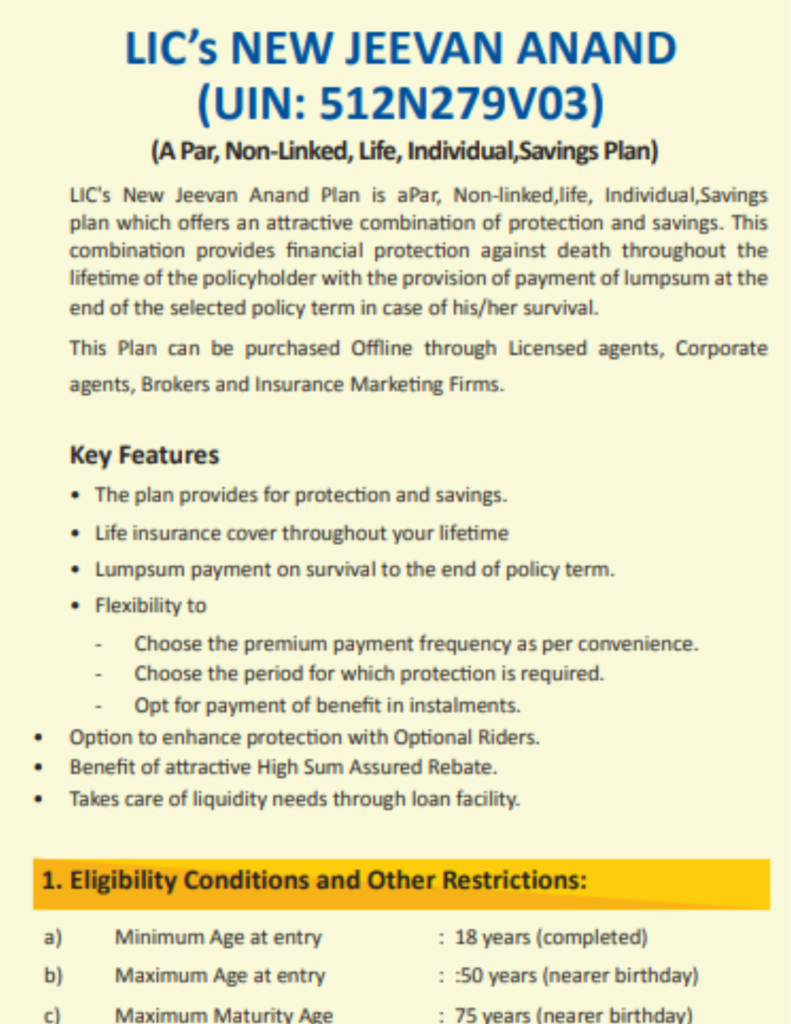

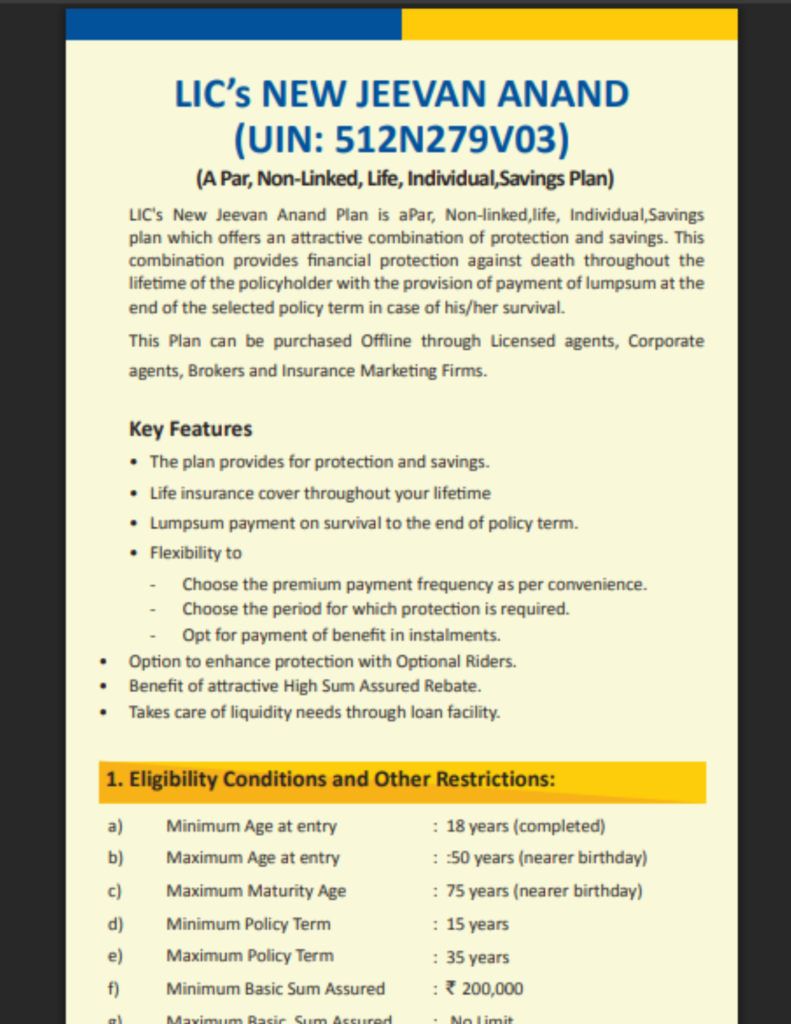

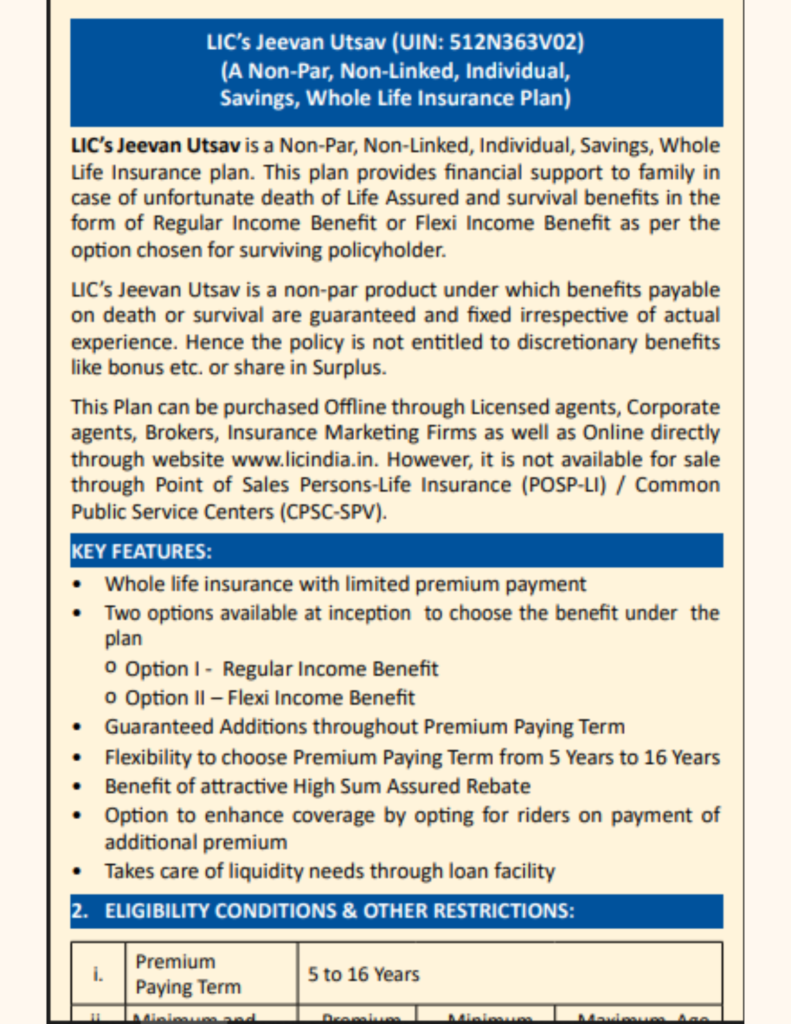

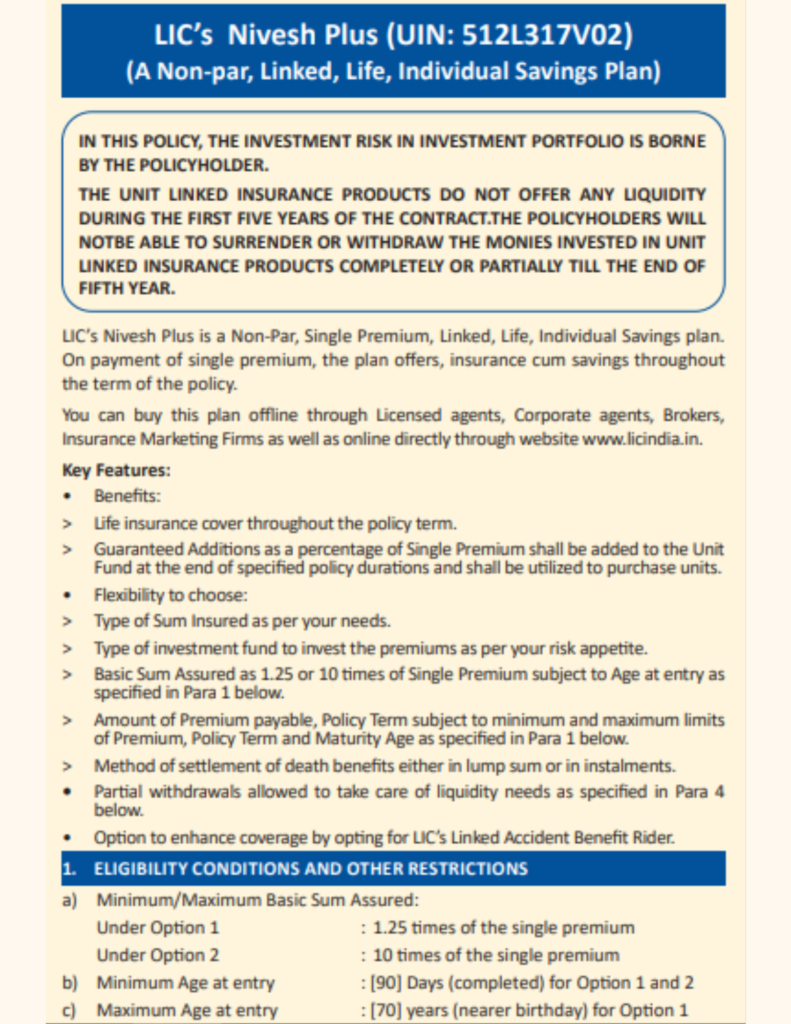

LIC OF INDIA

a) Retirement Policy

b) Child Education Policy

c) Term Insurance Policy

General Insurance

Bajaj Allianz General Insurance/ TATA Aig General Insurance

a) Vehicle Insurance

(b)Fire & Burglary Insurance

(c)Liability Insurance.

HEALTH INSURANCE

Star Health Insurance/ Care Health Insurance

a) Critical Illness Plans

b) Personal Accident Policy

c) Including Senior Citizen Plan

About Us

We are a trusted insurance service provider, offering a comprehensive range of insurance solutions designed to protect you and your loved ones. With our commitment to excellence and customer satisfaction, we partner with industry-leading providers to offer the best coverage options. Our Life Insurance services, in collaboration with LIC of India, provide financial security and long-term protection for your family. For Health Insurance, we are associated with Star Health Insurance and Care Health Insurance, ensuring your health needs are covered with extensive plans. Additionally, our General Insurance offerings, in partnership with Bajaj Allianz General Insurance and TATA AIG General Insurance, safeguard your valuable assets including vehicles, travel, and property.

With a personalized approach and transparent services, we strive to deliver insurance solutions that align with your needs and provide peace of mind. Your security is our mission, and we are dedicated to being your reliable partner on every step of your journey.

Our 3-D Process

01.

Initial Contact and Rapport Building:

Identify potential customers:

We use networks, referrals, and market research to find individuals who might benefit from an LIC policy.

Professionally our team explain our role as an LIC agent, and explain the customer our purpose of contacting them.

Ask open-ended questions to understand their current financial situation, life goals, and insurance needs.

02.

Assessment and Policy Selection:

We Pay close attention to their concerns, priorities, and risk tolerance.

Explain different LIC policies: Clearly describe various plans like endowment, term life, child plans, pension plans, and ULIPs, highlighting features and benefits relevant to their situation.

Tailor a customized solution: Based on their needs, recommend a policy that aligns with their financial goals and budget.

03.

Explain key terms:

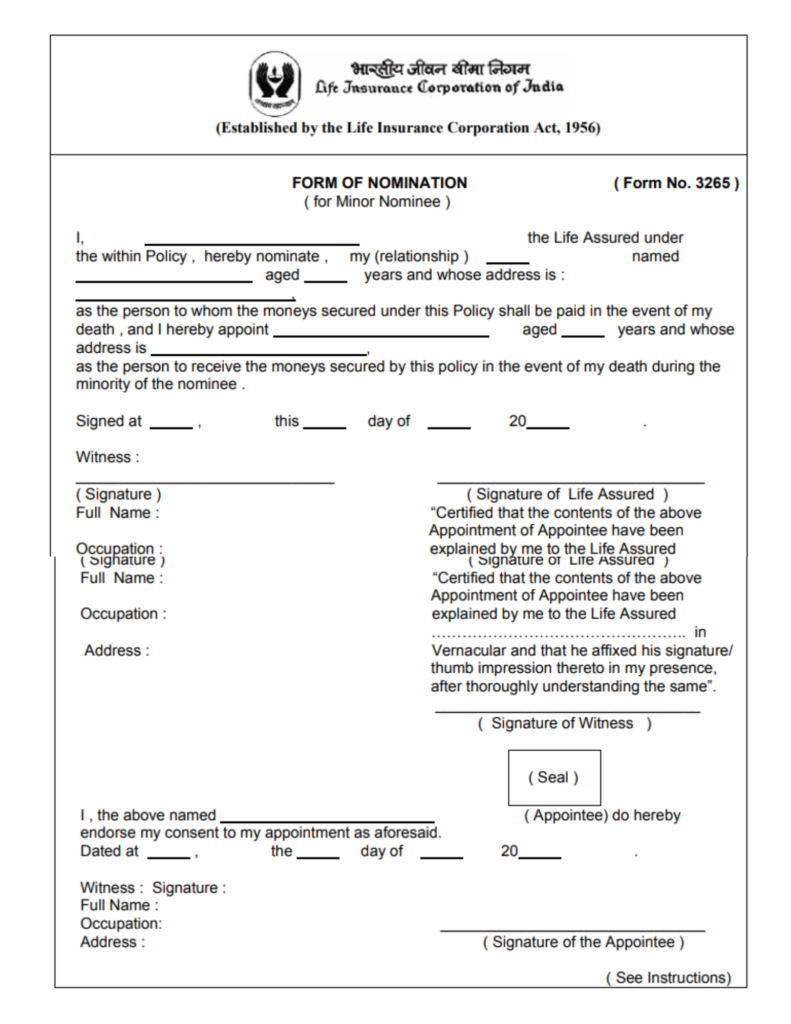

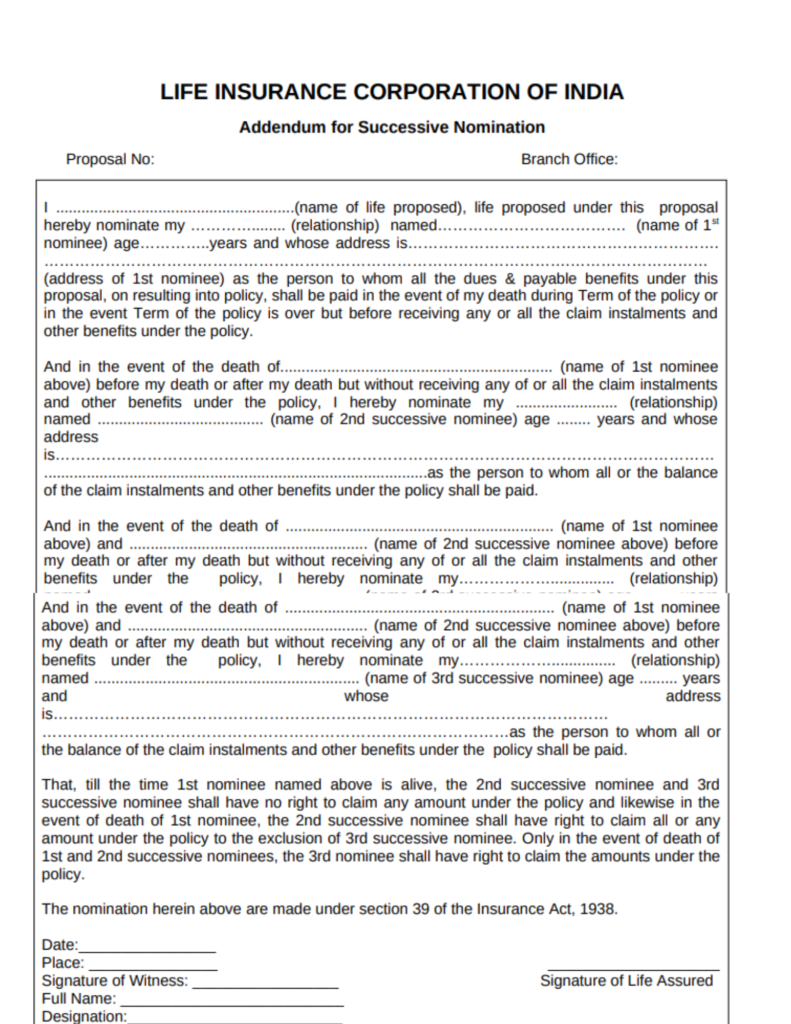

Our team Clearly define concepts like premium amount, policy tenure, sum assured, nominee, and riders.

Address potential concerns:

Answer questions about policy exclusions, surrender value, and claim process openly and honestly.

Provide illustrative examples:

Use real-life scenarios to demonstrate how the policy can benefit them in different situations to the customer

04.

Proposal and Application Process:

Present the proposal:

We Clearly outline the policy details, premium amount, and coverage based on their chosen plan.

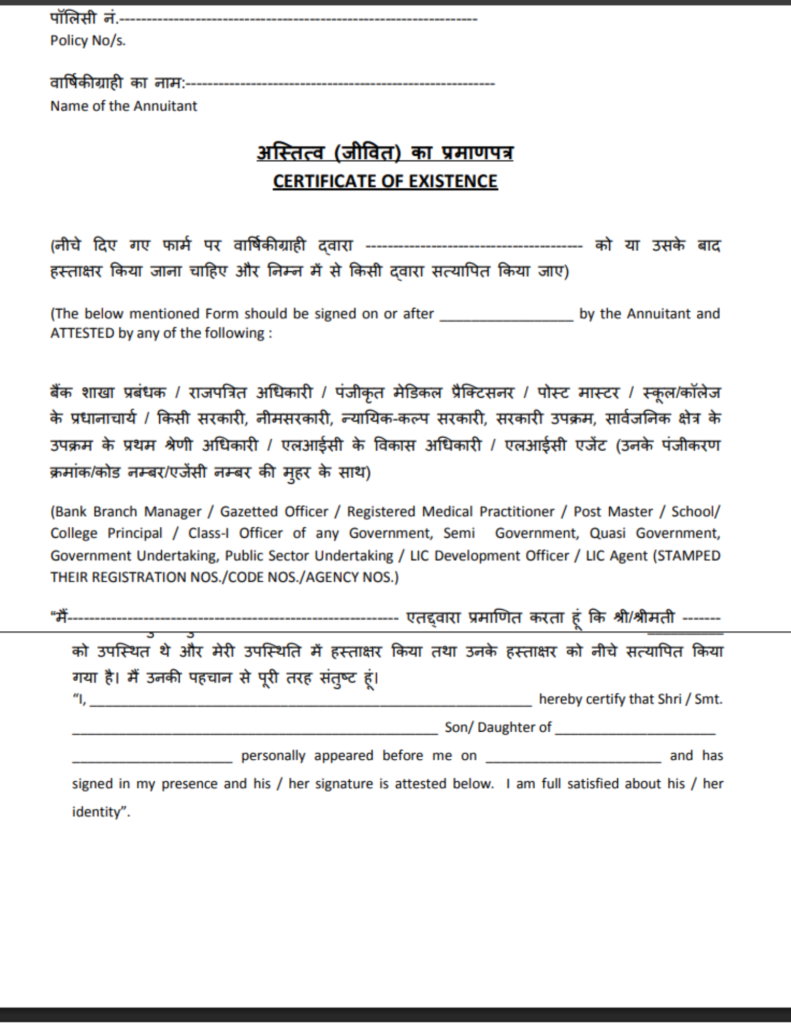

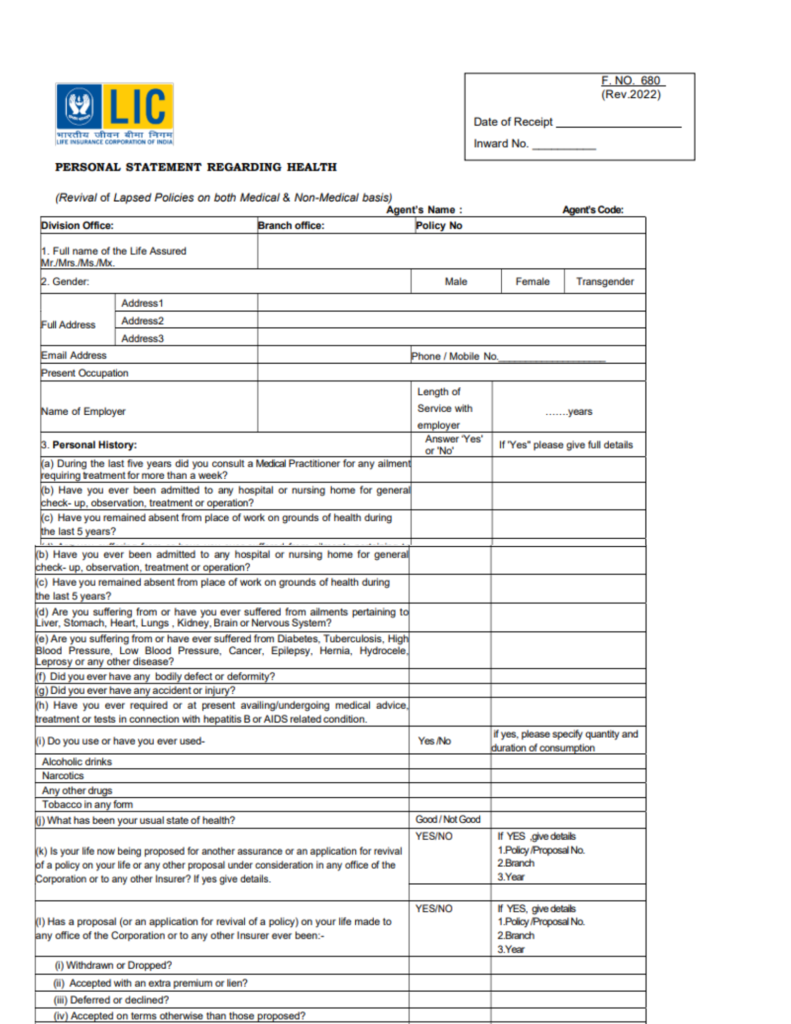

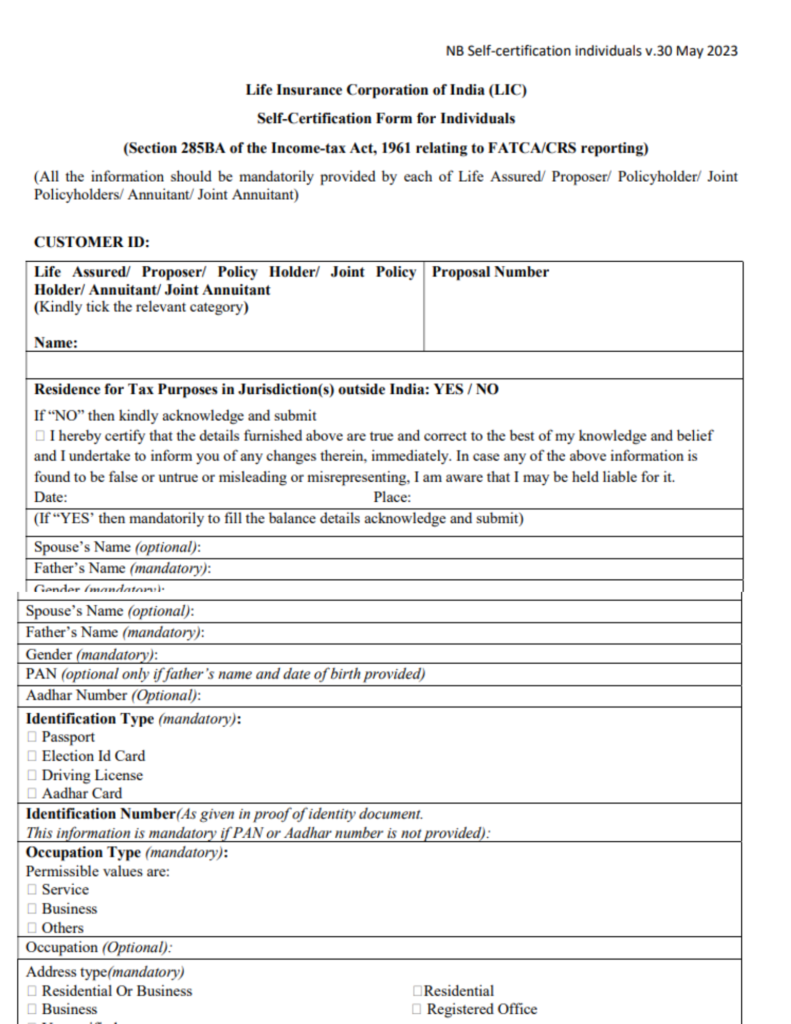

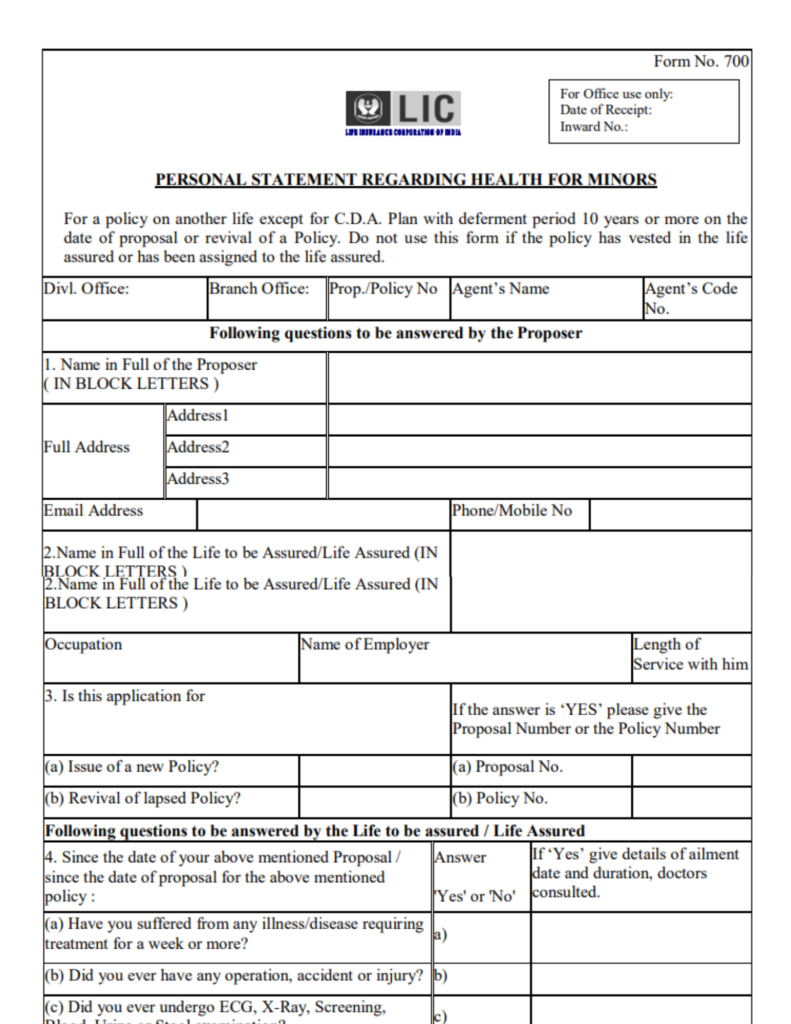

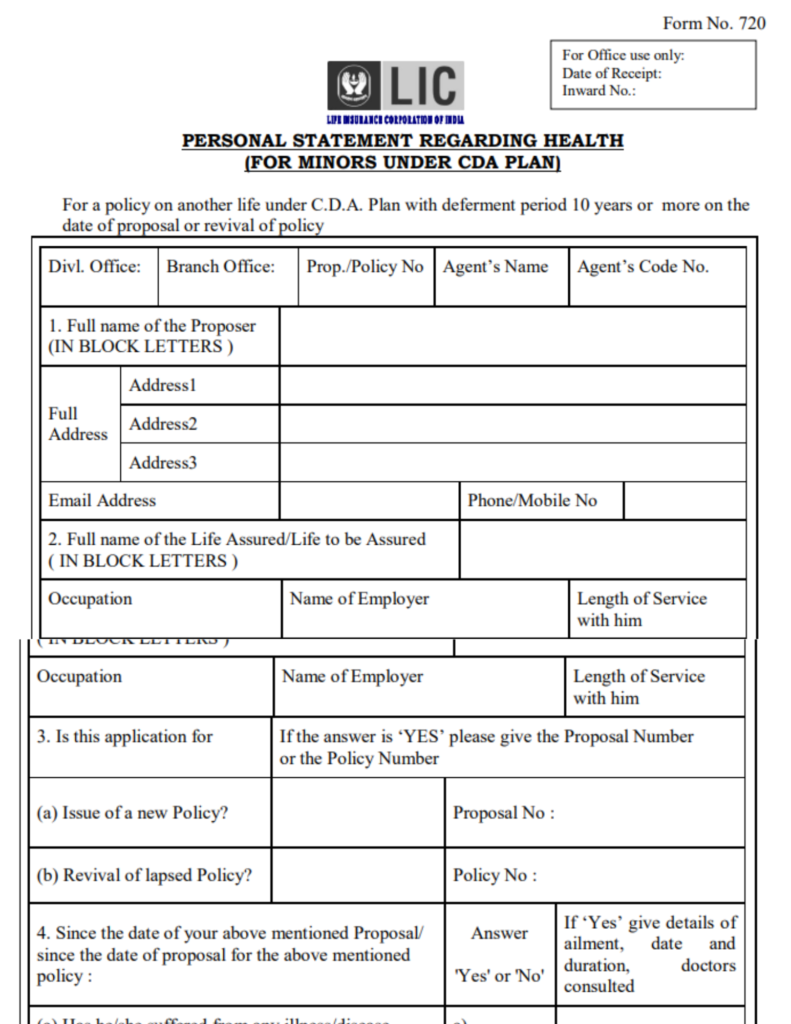

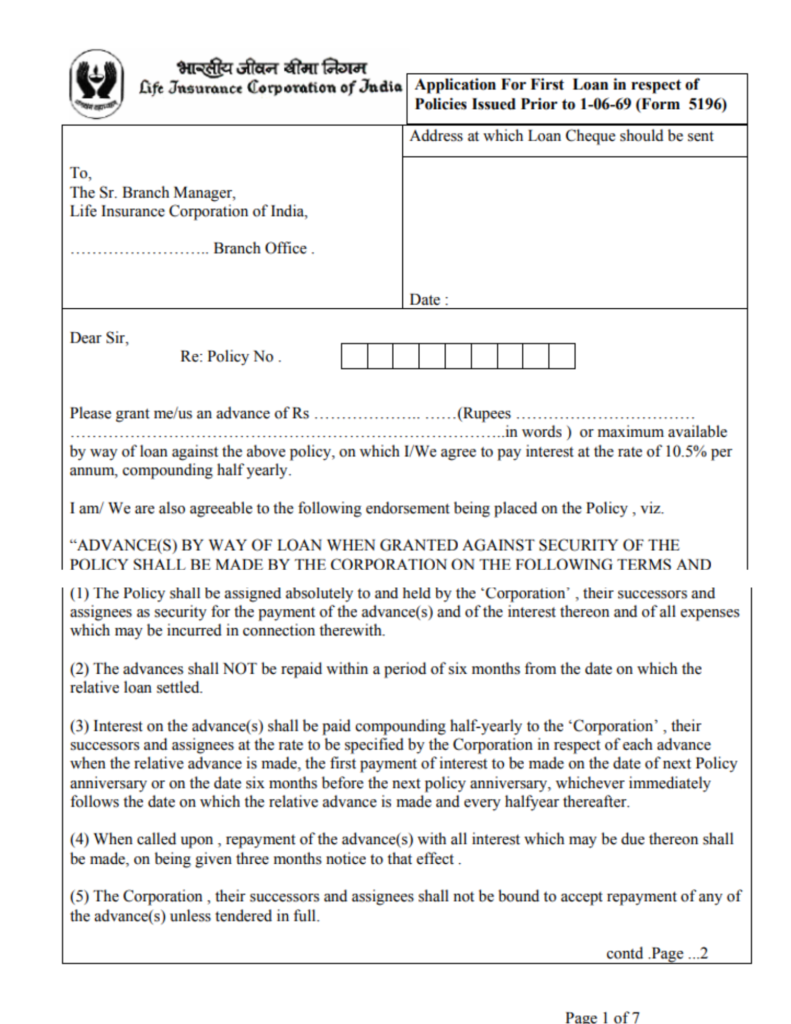

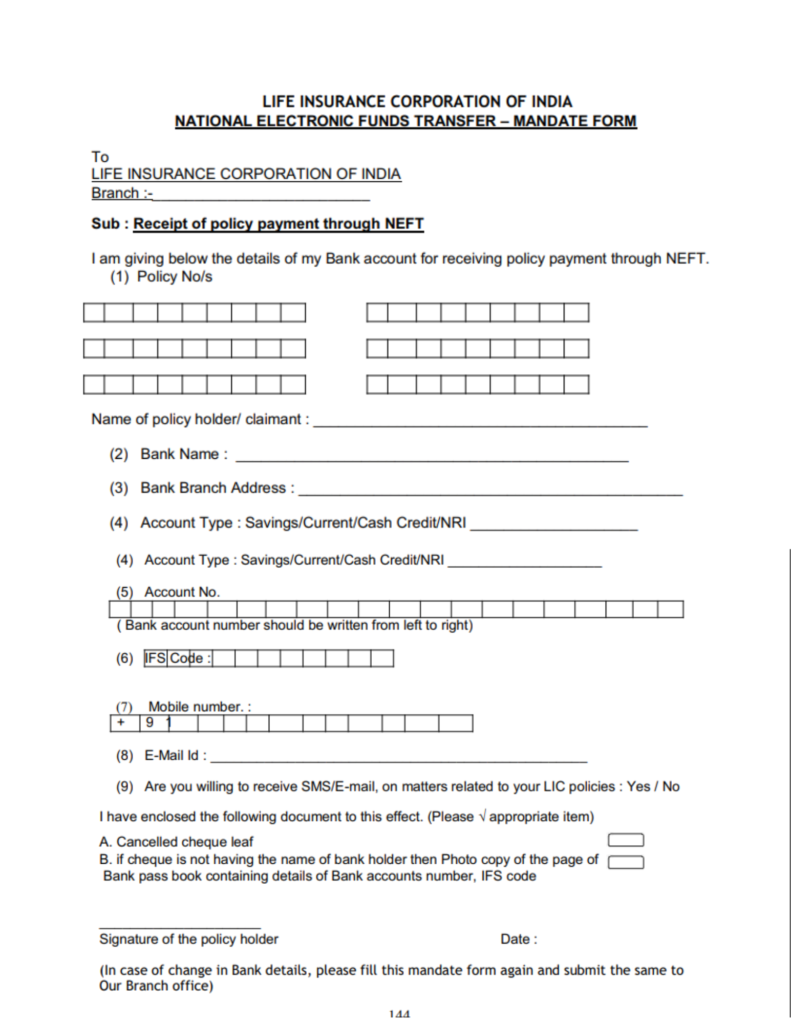

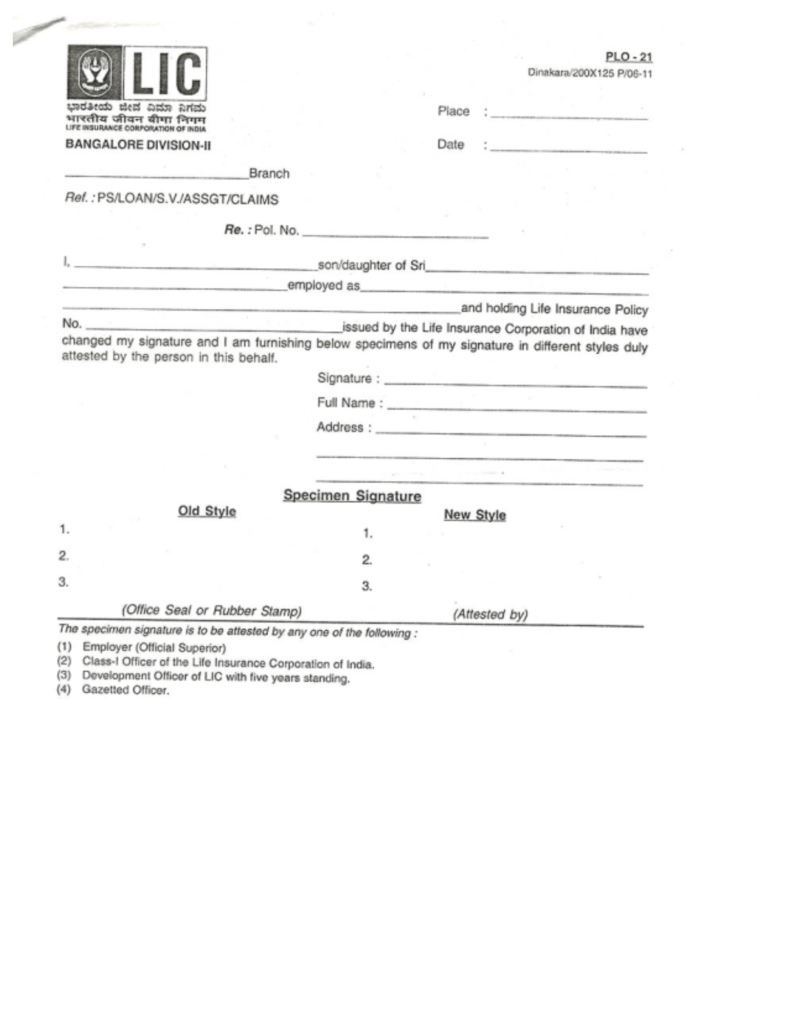

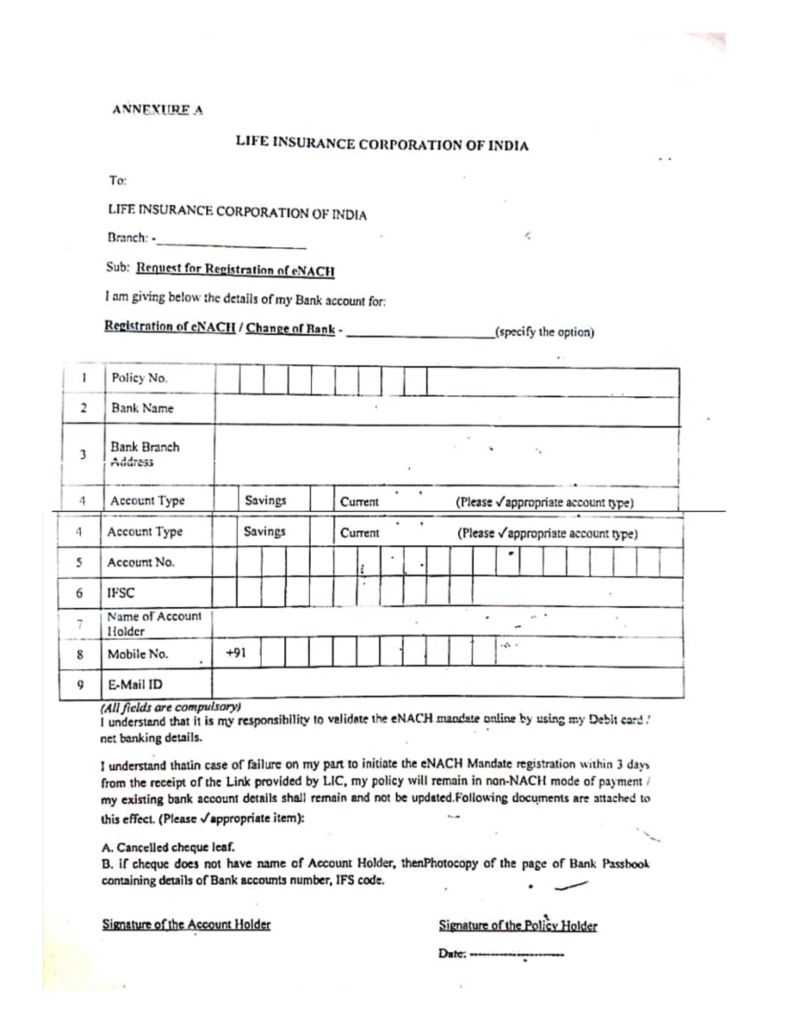

Fill out the application form:

Guide them through the necessary details accurately and ensure all information is complete.

05.

Medical examination:

If required, assist them in scheduling and completing the medical examination process.

06.

Follow-up and Customer Service

Regular communication: our team Maintain contact with the customer to address any questions, concerns, or policy changes.

Policy servicing: Help with premium payments, policy updates, and claim filing if needed.

We Build long-term relationships: Strive to become a trusted advisor by providing ongoing support and value.